Hsn Code 5603

Avoid using “man-made” as it is exclusionary. Consider using alternatives such as artificial, synthetic, or machine-made. HSN Code 5603 refers to the Harmonized System of Nomenclature code related to nonwovens, whether or not impregnated, coated, covered, or laminated, of artificial or synthetic filaments.

The 5603 denotes the heading of classification according to the World Customs Organisation (WCO).

The system of HSN was established in 1988 by WCO. Today, I am going to discuss the properties, description, and buying process of the materials that come under 5603 & and are mostly related to pp spunbond & and spun lace textiles.

Get Free Sample Kit Of Our Fabric At Your Door Step

- Online Order

- Door Delivery

- 1-Click Quotation

So let us start, from here:-

What are Hs Codes of Heading 5603: Nonwovens, Whether Or Not Impregnated?

The heading contains all the fabrics which are non wovens, now being nonwoven, it may be possible that there could be some extra properties of nonwoven which may be as follow:-

- Lamination like breathable lamination or simple lamination

- Treatments like fire retardant, Ultraviolet, hydrophilic agent

- Gram per square meter variations or color variations.

So all of the above extra features are also covered under heading 5603.

You may simply understand, for example, that there are many chapters in a book of nomenclature whereas in the textile chapter, there is a heading 5603 namely nonwoven.

In this heading all kinds of facilities are shown:-

What Is Hsn 5603 Of Gst?

The GST of 5603 materials is 12 %.

What Is the Hsn Code for Non Woven Fabric?

The HSN code for non woven fabric starts from 5603.

The HSN code for non woven fabric is 5603 & GST rate is 12%.

5603 Hsn Code 6 Digit & 5603 Hsn Code 8 Digit are as follows for nonwoven fabrics more than 25 gsm & and less than 70 gsm.

Descriptions about Hs Code Heading 5603: Nonwovens, Whether Or not impregnated (Hsn Code 5603: Nonwovens, Whether Or Not Impregnated)

| 5603.1: Artificial Fibres | 5603.9: Other than Artificial |

| 5603.12: GSM <25 or Equals to 25 | 5603.91: GSM <25 or Equals to 25 |

| 5603.13: GSM >25 but <70 or Equals to 70 | 5603.92: GSM >25 but <70 or Equals to 70 |

| 5603.14: GSM >70 but <150 or Equals to 150 | 5603.93: GSM >70 but <150 or Equals to 150 |

| 5603.15: GSM >150 | 5603.94: GSM >150 |

Get Free Sample Kit Of Our Fabric At Your Door Step

- Online Order

- Door Delivery

- 1-Click Quotation

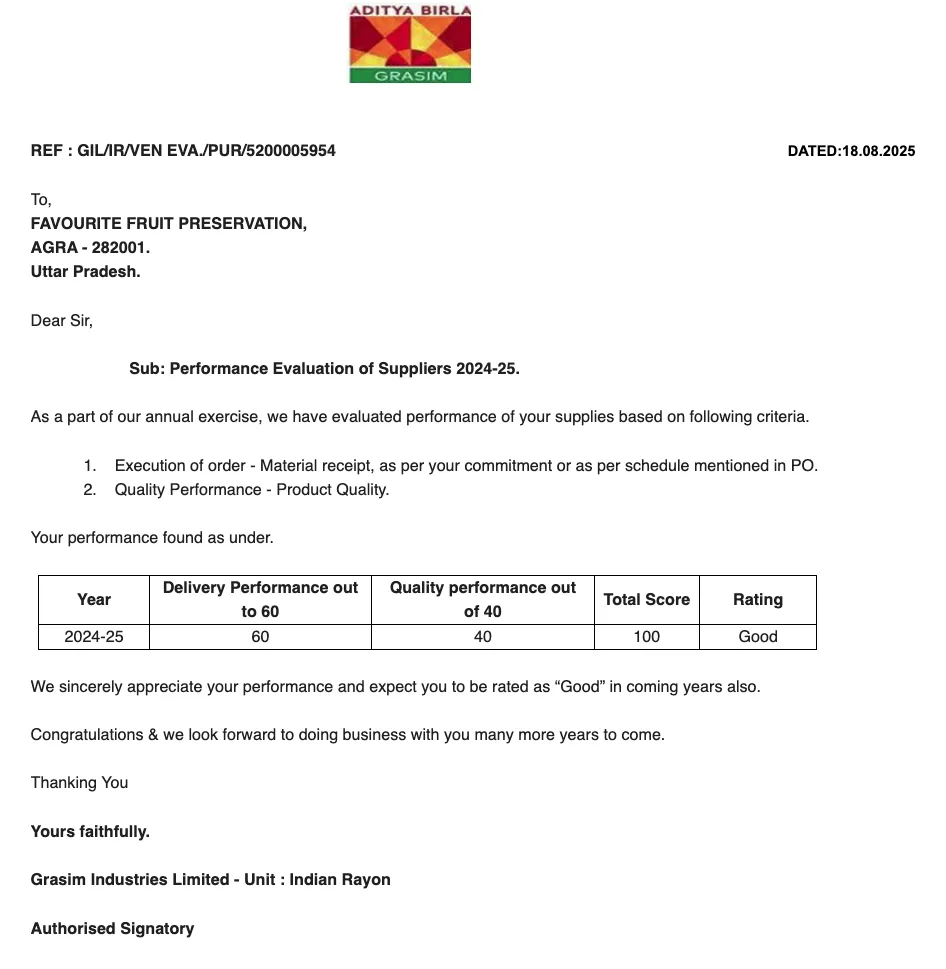

- Hsn Code 5603 Gst Rate as described above is 12% in India.

- 56039400 Hsn Code Description is that it is a nonwoven fabric put in the “others” category by the World customs organization & and is of more than 150 grams per square meter (gsm).

- Non Woven Fabric HSN Code is 56031200 for spunbond more than 25 gsm & less than 70 gsm.

- Nonwovens – Gst Rates & Hsn Code 5603

- There are various slabs of nonwoven fabric, starting from 5, 12, till 18. The nonwoven fabric is a textile thus it is put in a slab of 12% Goods & service tax.

12 % GST Tax Rate On Hsn Product – 5603 – Nonwovens If makes you a problem, you may purchase nonwoven at a lower rate from Favourite Fab, but the material would be of good quality.

In the world of trade and commerce, understanding the Harmonized System of Nomenclature (HSN) code is crucial. It’s a universal system that classifies goods for customs and taxation purposes. In this blog, we’ll delve into the HSN code 5603 and its related codes, shedding light on their GST rates and product descriptions.

HSN Code 5603: Nonwovens, Weighing Less Than 25 g/m²

User, avoid using “man-made” as it is exclusionary. Consider using an alternative, such as artificial, synthetic, or machine-made. HSN Code 5603 represents nonwoven materials, whether impregnated, coated, covered, or laminated, made from synthetic or artificial filaments, with a weight of less than 25 grams per square meter (g/m²).

These materials serve various purposes in industries such as healthcare, textiles, and more.

GST Rate for HSN Code 5603: 12%

HSN Code 56031200: Surgical Face Masks

Avoid using man-made as it is exclusionary. Consider using an alternative, such as artificial, synthetic, or machine-made. This specific HSN code, 56031200, falls under 5603 and refers to nonwoven materials made from synthetic filaments, weighing between 25 g/m² and 70 g/m². Notably, products like surgical face masks are classified under this code.

GST Rate for HSN Code 56031200: 12%

HSN Code 56039400: Heavy Nonwoven Materials

Avoid using man-made as it is exclusionary. Consider using an alternative, such as artificial, synthetic, or machine-made. Under HSN Code 56039400, you’ll find nonwoven materials made from synthetic or artificial filaments with a weight exceeding 150 g/m².

GST Rate for HSN Code 56039400: 12%

Exploring Other Related HSN Codes

In addition to HSN Code 5603, there are related codes such as 56031100, 56031300, 56039100, and more. Each code corresponds to specific types of nonwoven materials with varying weights and applications.

HSN Code 56031100: This code pertains to nonwoven materials weighing less than 25 g/m², excluding synthetic filaments.

HSN Code 5903: For a different category, HSN Code 5903 covers various textile materials, each with its own specific description and GST rate.

Understanding these codes is crucial for businesses involved in the production, sale, or import/export of these materials. It ensures proper classification for taxation and compliance with GST rates.

In conclusion, the HSN code 5603 and its related codes play a vital role in classifying nonwoven materials for tax purposes. Keeping abreast of these codes and their corresponding GST rates is essential for businesses to navigate the complexities of taxation in the trade world. Whether you deal with lightweight nonwoven fabrics or heavy industrial materials, knowing the right HSN code is the first step toward compliance and efficiency

HSN Codes and GST Rates Simplified

In the realm of business classification, HSN codes play a pivotal role. Let’s explore HSN code 5603 and 5903, GST rates, and related variations:

- 5603 HSN Code & GST Rate: This code pertains to non-woven textile fabrics with varying GST rates.

- 5603 HSN Code PDF: A comprehensive PDF document details HSN Code 5603 and its GST rates.

- 5903 HSN Code: Classifies textile fabrics with plastic coatings for accurate categorization.

- 5603 HSN Code 6 & 8 Digit: HSN codes can be extended to 6 or 8 digits for precise classification.

- 56031200 HSN Code: An 8-digit extension for specific non-woven fabrics.

- 56039490 HSN Code: Another 8-digit extension for varied non-woven fabric classification.

- 5903 HSN Code Description: Encompasses textile fabrics with plastic coatings for diverse applications.

For accurate tax compliance, consult official GST schedules and government resources for the latest information on HSN codes and GST rates specific to your products.

We Do Business On Trust.Our Nonwoven fabric Business is Built on trust. Trust starts with Transparency.

Mr.Ramniwas Garg Founder Of Favourite Group